The Invoice Reference Number (IRN) and QR Code are integral features of the FIRS-MBS platform, designed to ensure transparency, authenticity, and traceability in invoicing and tax processes.

What is IRN?

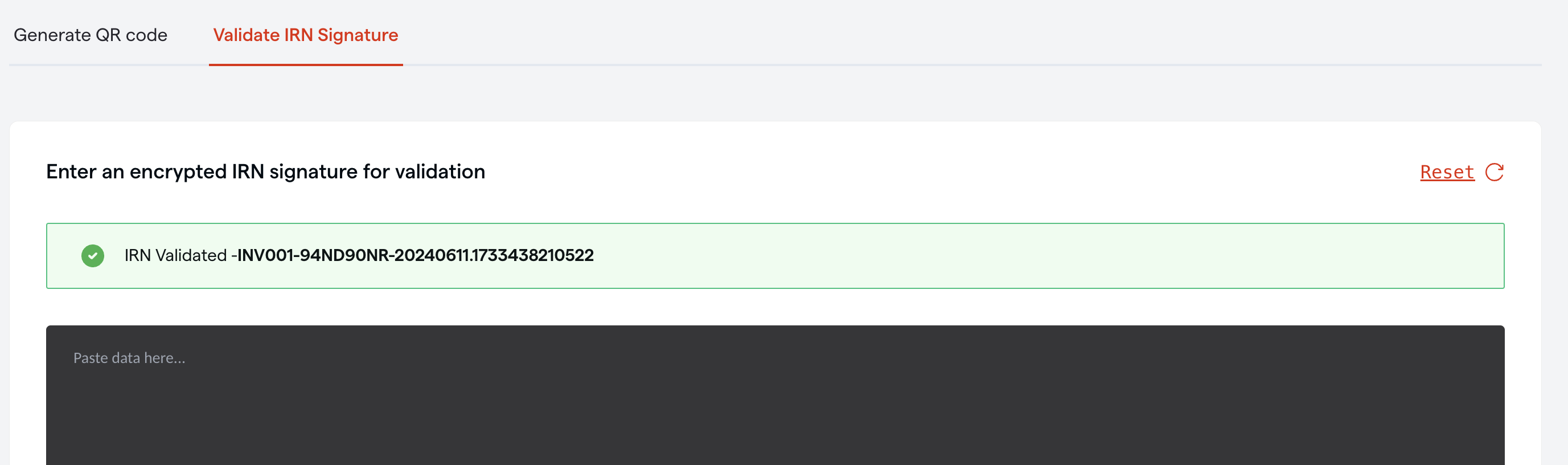

The Invoice Reference Number (IRN) is a unique identifier assigned to each invoice generated or validated on the FIRS-MBS platform.

- Purpose: Tracks every invoice for audit, compliance, and verification purposes.

- Structure: It contains specific details about the invoice, including the taxpayer's identification and the transaction date.

- Usage: Helps both businesses and FIRS easily verify the legitimacy of issued invoices.

What is a QR Code?

The QR Code is a scannable code embedded on every invoice, providing quick access to invoice details.

- Purpose: Enhances invoice verification and reduces fraud by making invoice details easily accessible.

Functionality: When scanned, the QR Code displays information such as the IRN, taxpayer details, and invoice summary, directly connecting to the FIRS database for validation.

Benefits of IRN and QR Code Integration

- Enhanced Transparency: Ensures that all invoices are traceable and compliant with tax regulations.

- Fraud Prevention: Minimizes invoice manipulation through centralized verification.

- Ease of Use: QR Codes simplify the process of validating invoices on-the-go, accessible via mobile devices.

- Efficient Audit Process: IRN and QR Code streamline record-keeping and tax audits for businesses and FIRS alike.

Pro Tip: Always verify invoices using the QR Code to ensure compliance and authenticity!